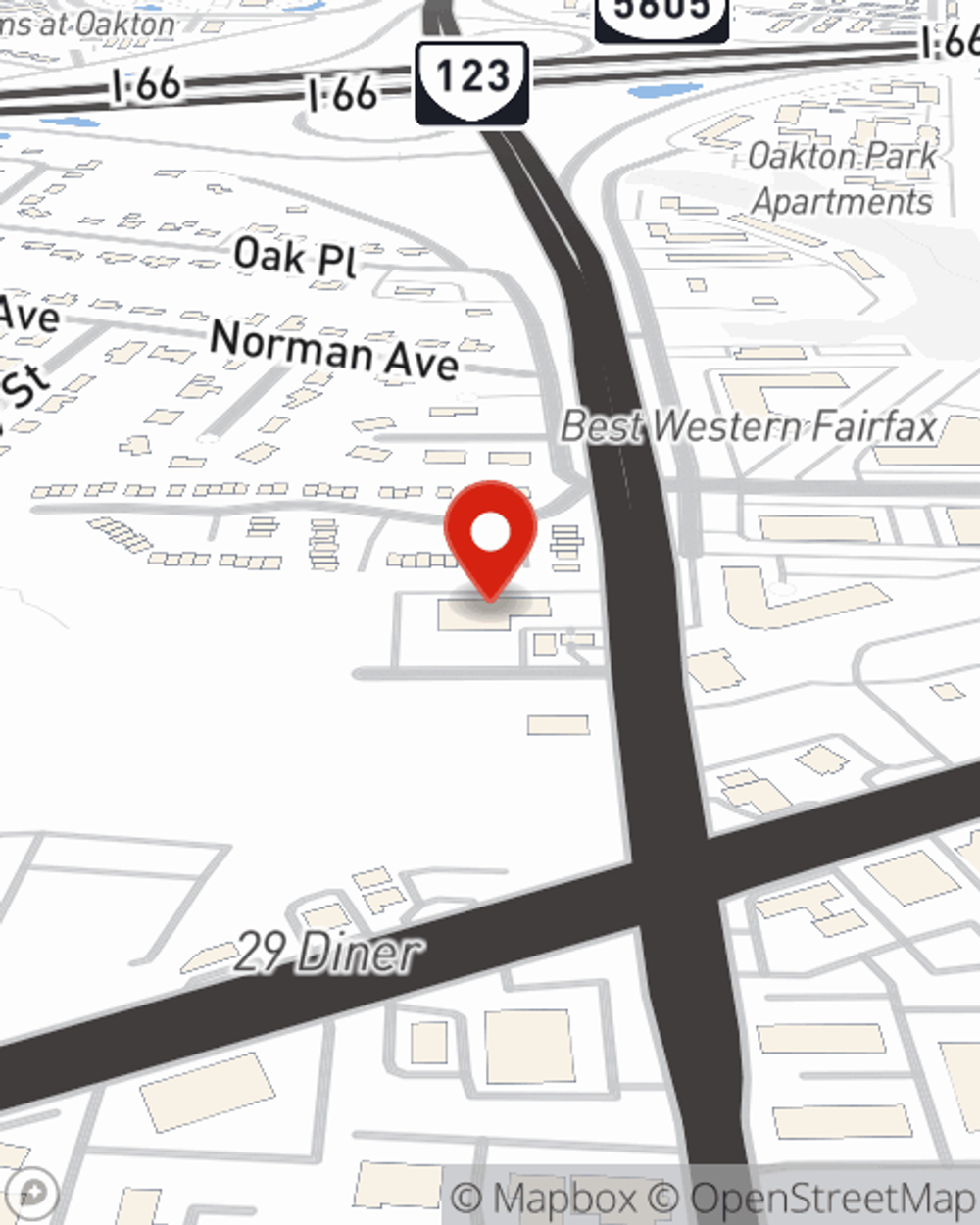

Business Insurance in and around Fairfax

One of Fairfax’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Insure The Business You've Built.

Preparation is key for when something unavoidable happens on your business's property like an employee getting injured.

One of Fairfax’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Get Down To Business With State Farm

With State Farm small business insurance, you can give yourself more protection! State Farm agent C Kim is ready to help you handle the unexpected with reliable coverage for all your business insurance needs. Such considerate service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If mishaps occur, C Kim can help you file your claim. Keep your business protected and growing strong with State Farm!

Don’t let worries about your business keep you up at night! Get in touch with State Farm agent C Kim today, and find out how you can benefit from State Farm small business insurance.

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

C Kim

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.